Torben Pedersen (CBS) and Peter D. Ørberg Jensen (CBS)

The “vaccine club” is a term used for a group of countries that have the capacity to produce vaccines - they include China, Germany, India, Russia, the U.K., and the U.S. These countries also manufacture most of the ingredients needed for vaccines. Therefore, many parts of the world are bound to rely on the "vaccine club" countries to overcome COVID-19 or any other virus.

The TWIN SEEDS project gathered new data on the vulnerability and flexibility of supply chains that rely on a few offshore locations for cost-effective global production of vaccines.

The COVID-19 was an eye-opener, and many things have changed, not least in Europe, which was not very well prepared for the pandemic and didn’t have the institutions and capacity to act fast and agile enough when COVID-19 spread around the whole world. Vaccine research has experienced fluctuations over time; in the late 1990s, promising findings suggested that cancer vaccines could be feasible, leading to a surge of investment from major pharmaceutical companies. However, after many vaccine trials failed, these companies withdrew their funding and left the field to academic institutions and smaller biotech firms. Currently, there is a renewed interest and investment from big pharma in vaccine research, especially in the mRNA vaccine technology that has potential applications for cancer treatment. As a result, vaccine researchers are highly sought-after and scarce in the market.

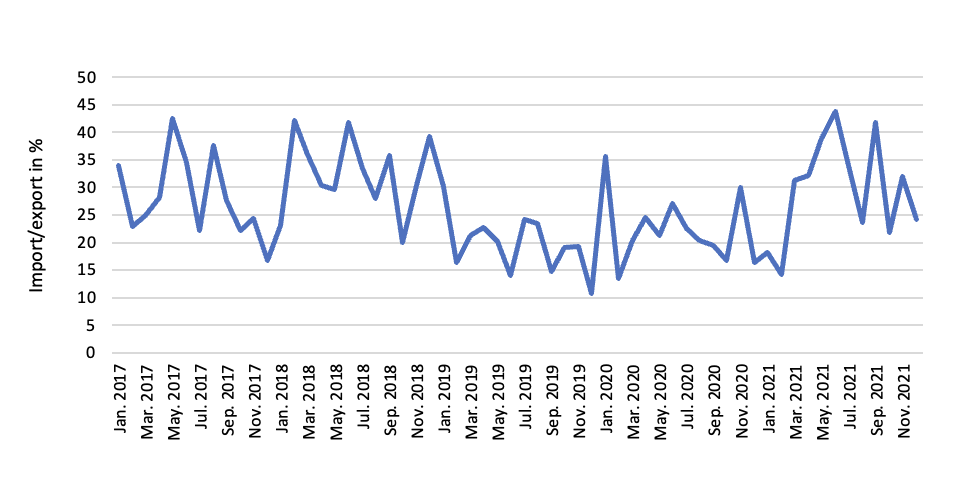

Between January 2017 and November 2021, export of vaccines from Europe was much higher than import to Europe as the share of import over export typically varied between 20-40%, which implies that Europe is producing more vaccines than used in Europe and thereby becoming a net exporter of vaccines (Figure 1). We saw a short spike in imports around January 2020 when the first COVID-19 vaccines were released, but then the share of imports decreased and normalized at the same level as before the pandemic. The reason for the increased imports around January 2020 was that the U.S. companies had a strong start as they were fast in ramping up production - mainly because of Operation Warp Speed). However, as the European companies started production (e.g. BioNTech in Germany, AstraZeneca in the UK and Belgium) and the U.S. companies established production facilities in Europe (e.g. Moderna in Spain and Netherlands, Johnson & Johnson in Italy and Spain) the share of imports went down.

Europe is in a much better position today than before the pandemic but also pointed out that much of the money today goes mostly to research on the mRNA vaccine. mRNA vaccines have shown good efficacy against COVID-19, but their performance against other potential pandemic viruses is unknown. Therefore, investment in a diverse range of vaccine technologies is needed without limiting the research to one technology only. One of the challenges in vaccine research is the uneven distribution of resources. Most of the funding from big pharma goes to the vaccine types that have the highest potential for cancer treatment, leaving other vaccine types with less support. This means that the research on other vaccine types is mainly done by universities and some state funding, resulting in a more fragmented and sporadic landscape.

The industry has made remarkable progress in building, filling and finishing vaccine production facilities across Europe. It now has much more capability and capacity to manufacture vaccines than it did before. This enhanced platform will enable Europe to increase its output much more quickly in the future. The existing manufacturing facilities include facilities set up by European and US pharma companies. They have been collaborating in fast scaling up, where, e.g. the European contract manufacturers Lonza and Catalent supply the Moderna vaccine, and Pfizer-BioNTech is teaming up with Sanofi, Novartis, and Merck to scale up production of their vaccine. What remains a problem are the vaccine ingredients. Although most of the more than 200 vaccine ingredients that are needed to make the vaccine are sourced in Europe, firms did experience substantial delays in deliveries of some of the ingredients during the pandemic. The most severe bottleneck, however, was with the components imported from China. These components are rare and hard to find elsewhere, and their delivery time increased from days to months during the crisis. Companies tried to find other sources, but none of them met our quality standards. During the pandemic vaccine producers complained about a series of input shortages such as lipids, bioreactor bags, filtration pumps, and other equipment and raw materials that were in short supply.

Although the orchestration of combined capabilities thus far has been admirable, the complexity of the vaccines constitutes a risk for the future resilience of the vaccine value chain. This complexity is the result of the combination of the specialized ingredients, the large number of suppliers involved, and the locational spread of the suppliers across many countries. The combination of these factors makes the vaccine value chain vulnerable to disruptions. This vulnerability also includes a geopolitical dimension, with several suppliers located in China, and could therefore entail increased future dependency on China, which is not desirable from a European policy perspective.