Jorge Zafrilla (UCLM), Katarzyna Mroczek-Dąbrowska (PUEB), Barbara Jankowska (PUEB) and Ángela García-Alaminos (UCLM)

The key phenomenon in globalisation and the internationalisation of global value chains has been the localisation of foreign direct investments (FDI) by multinational corporations (MNE) seeking new markets. Geopolitical tensions and the push for a green transition alter these FDI location decision patterns.

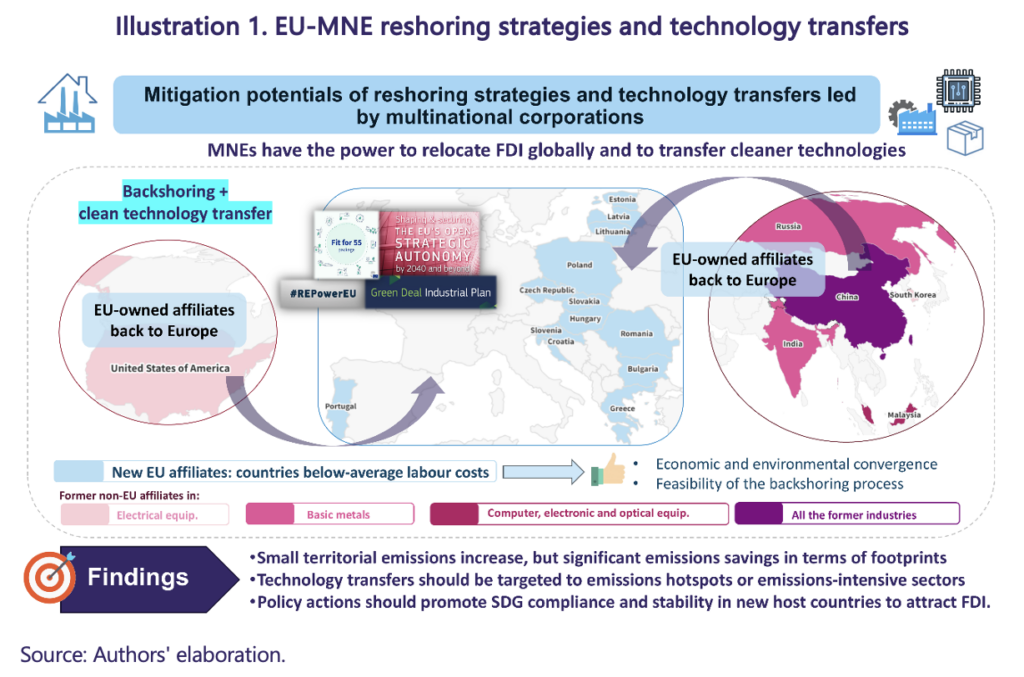

The transfer of knowledge from home countries by MNEs has enabled low-wage nations with lax environmental regulations to industrialise like never before. As part of the EU's resilience strategy, hypothetical processes of reshoring MNEs to the EU or peripheral countries are being evaluated. It is essential to identify the knowledge gaps regarding the potential for reshoring and the technological transfer potential to avoid compromising the EU's environmental performance. The role of Eastern and Southern European countries in attracting private capital while ensuring low-carbon technology transfer will be crucial for the success of policies promoting the shortening of global production chains led by multinational companies.

In this context, MNEs face significant pressure to reduce their environmental impacts. It is vital to analyse the opportunities presented by the need to restructure global and regional production networks based on less greenhouse gas-intensive production models with a strong focus on sustainability and circularity.

MNEs play a crucial role in restructuring global trade. The EU-led reshoring of strategic products to peripheral EU countries in Eastern and Southern Europe can create synergies with climate change efforts and promote convergence in these regions. Results show that reshoring low-emission strategic sectors like Computer, electronic, and optical equipment, or Electrical equipment to the EU slightly increases emissions within our borders by 1.2% and 0.4%, respectively. For energy-intensive strategic industries like Basic metals, the emissions increase is also moderate, with only a 0.2% rise in EU emissions. Technology transfers between the parent company and the new subsidiary in low-carbon sectors do not significantly reduce emissions, as there are minimal differences in technology between these groups of countries (average emissions are 3% lower). However, for more energy and emission-intensive sectors like Basic metals, technology transfers significantly reduce emissions, with a 45% lower footprint increase.

Our results support that, in terms of environmental improvements, it is more efficient to focus technology transfer not directly on the strategic sector but on sectors that indirectly correspond to the emissions hotspots of the value chain. In this regard, simulations on the decarbonisation of the electricity sectors in new EU countries that would host the production of these strategic sectors lead to a significant reduction in emissions within the EU, ranging from 10.4% to 11.2% across all industries. Enhancing resilience within the EU should involve decarbonising the entire EU, accelerating the process in peripheral countries lagging behind the core EU countries.

Case studies on the location and technology transfer decisions of MNEs reveal that environmental issues are crucial for corporate sustainability. Although environmental changes are measured at the corporate level, foreign subsidiaries adopt solutions individually, in agreement with the parent company, but without unification. MNEs have a "set of best practices" that can be used as a reference throughout the organisation, although subsidiaries are not required to adopt them as long as they meet Key Performance Indicators (KPIs).

Unlike in the past, current decisions on FDI location depend more on the host country's ability to comply with home-country regulations, such as achieving climate neutrality, provided other economic and market criteria are met. However, environmental factors remain secondary to costs or market access. Policy objectives within the EU should motivate compliance with the SDGs and generate stability in new host countries, as this will be a crucial element in the attractiveness of these countries for FDI led by MNEs.